Charging F&A Costs

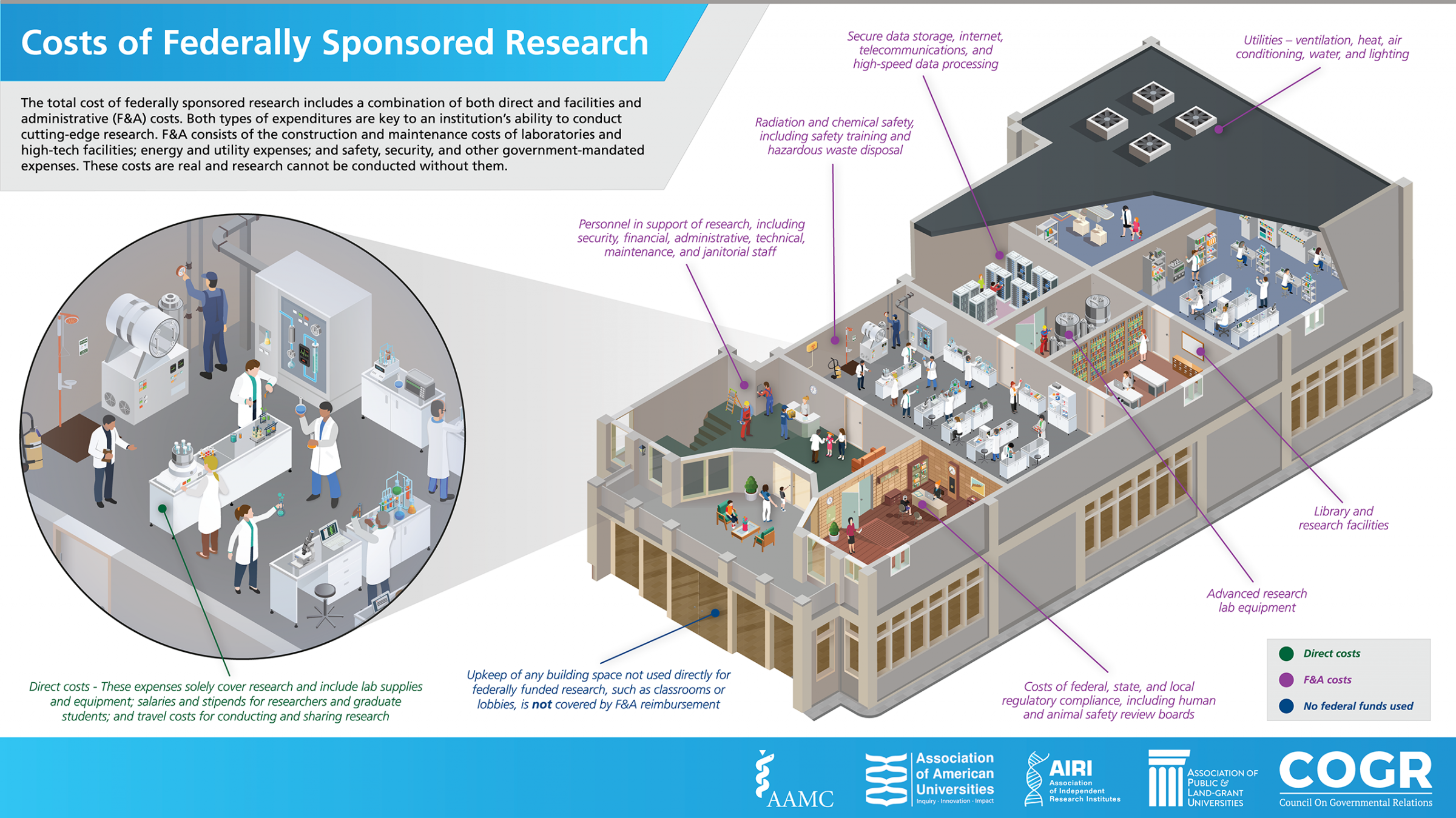

When universities, like the University of Arizona, perform research on behalf of the federal government through agency grants, contracts, or other agreements, the University incurs costs, called Facilities and Administrative (F&A) costs (sometimes called indirect costs in the vernacular). F&A costs, defined by the Office of Management and Budget Uniform Guidance 2 CFR, Part 200.56 encompass: the maintenance of sophisticated, high-tech laboratories and research facilities; utilities such as lighting and heating; hazardous waste disposal; data-storage; information technology and internet services; and the administrative support required to comply with various federal, state, and local regulations and reporting requirements. Historically, the federal government has partnered with research universities to pay for these critical and necessary research expenses, just as it does when it contracts with industry or utilizes its own federal laboratories to conduct research. F&A costs are nicely summarized in the following infographic (courtesy of AAU).

All grants, contracts and other sponsored agreements accepted by the University of Arizona are subject to the current federally negotiated F&A rate. The currently applicable rates are outlined in the April 2023 Rate Agreement letter from the Department of Health and Human Services and are also available on the Facilities & Administrative (F&A) Rates page.

Budgeting the Federally Negotiated F&A Rates

It is the University of Arizona’s policy to request the appropriate federally negotiated F&A rate for all sponsored activity regardless of funding source, the federally negotiated F&A rate will be the basis for budget purposes on all sponsored activity. If a sponsoring agency limits or forbids the reimbursement of F&A based on federal/state/local law, administrative regulation, or published sponsor policy, the following exceptions for Federal Flow through or Stipulated F&A Rates apply.

Federal Flow-through Awards

When funding flows from a federal prime sponsor to the University of Arizona, through a pass-through entity, as in the case of federal flow-through awards, the University will accept stipulations that meet the requirements of Uniform Guidance 2 CFR 200.414:

- Federal agencies may stipulate a rate different from a negotiated rate only when required by Federal statute or regulation, or when approved by a Federal awarding agency head or delegate based on a documented justification approved by the Office of Management and Budget.

- The pass-through entity (prime awardee) should not impose F&A restrictions beyond what is stipulated above.

Documentation for a stipulated rate must be included with the proposal. To document a stipulated rate, attach a copy of the law, regulation or published policy stating the limitation on F&A reimbursement under the Abstracts and Attachments tab in the UAccess Research proposal document.

F&A Cost Rate Stipulations

A reduced reimbursement of F&A costs is allowable when stipulated (required) by a sponsor. The University will honor a stipulated rate if the sponsoring agency has a formal, published policy regarding the reimbursement of F&A costs. The stipulation must come from the sponsor’s bylaws, published agency guidelines, administrative regulation, formal solicitation, program announcement or application kit.

If no formal stipulation regarding the reimbursement of F&A costs exists, a letter stating the restrictions on F&A may be substituted:

- The lower rate must apply universally to all grantees, not just to the proposal in question.

- The request must come in the form of written documentation from the sponsor, on official agency letterhead, stating the limitation on the reimbursement of F&A costs.

- The letter of request must be endorsed by the agency Chief Executive Officer, Chief Financial Officer, Contracts/Grants Officer or equivalent.

E-mails from a sponsor stipulating a reduced rate do not qualify as stipulations and will require a waiver. No exceptions.

Documentation for a stipulated rate must be included with the proposal. To document a stipulated rate, attach a copy of the law, regulation or published policy stating the limitation on F&A reimbursement under the Abstracts and Attachments tab in the UAccess Research proposal document. If an Administrative Change needs to be routed for an award with a stipulation, the stipulation will need to be included in the Administrative Change submission.

F&A Waiver Requests

The purpose of providing these guidelines is to address, clarify, and otherwise provide consistency in the application among campus of a university-wide policy when it pertains to F&A waivers. In doing so, the UA intends to allow for enough flexibility so that departments may properly judge what is of vital interest to their units.

At the University of Arizona, the office of Research, Innovation and Impact (RII) retains authority to grant waivers of F&A costs on proposals and awards. RII will consider requests for indirect (F&A) cost waivers only in very limited circumstances. F&A costs represent true costs of a project, any waiver request should be limited only to those rare circumstances where the benefit to the UA outweighs the monetary loss.

The decision whether to grant or deny a waiver request is at the sole discretion of RII but is in concurrence with the approval from the representative Department head, and Dean or Associate Dean for Research. These offices will work with RII to review and obtain the approval in advance of a UAR application or contract. All requests must use the F&A Waiver Request Template with the Department Head and Dean or Associate Dean for Research approval and must be submitted with a UAR proposal no less than five working days in advance of the deadline. Failure to submit the request in sufficient time for review and approval may result in submission at the full F&A rate. All information requested on the form must be included at the time of submission for final approval.

Any waiver exception granted for an individual award will apply only to the proposed period and the proposed amount of the award, as stated in the reduction request for a maximum period of five years. This is provided there is no material change in the project that affects the basis on which the waiver was approved. A waiver granted on this basis will be limited to awards which are within the parameters of the original request, that is, the specific named sponsor, program, or RFP and will apply until the basis for granting the waiver changes. Long-standing waivers (older than five years) and supplement requests will be periodically reviewed by RII to determine whether sponsor policy or practices have changed.

When considering whether or not to request a waiver, it is important to note the small size of the grant or increased competitiveness are not acceptable justifications. No agreement for reduced F&A costs can be made with any sponsor prior to RII approval. A PI does not have the authority to apply without, reduce, or waive the F&A rate or to accept or negotiate a reduced or waived F&A rate with a sponsor. These scenarios in concert with the list below are justifications that will not be accepted or entertained when considering a waiver approval:

- Waivers requested solely because an award does not provide adequate direct costs for completion of the full scope of the project

- Waivers that will not provide equitable treatment to all University researchers applying to the same sponsor

- Waivers for awards under which intellectual property rights do not remain with the University

- Waivers based solely on precedent

- Waivers requested exclusively due to “already awarded” agreements or any awarded application submitted outside of the purview of RII

- Waivers for the purpose of meeting cost share requirements without a corresponding commitment from Department and College for a proportional direct cost commitment

- Waivers for an Industry Sponsor or Foreign Government

The F&A Waiver Request Template must be included with the corresponding UAR Proposal and routed to SPS at least 5 full business days before the sponsor's due date.

Please find the following FAQs to assist with any inquiries regarding F&A:

Fixed Price Project F&A Waiver/Cost Rate Reductions

If a fixed price project with an F&A waiver/cost rate reduction has unspent residual funds at the completion of the project, F&A will be recalculated and applied based on the full rate applicable for the activity type. Remaining funds in a fixed price project with a F&A waiver demonstrate the cost reduction was not necessary for the project objectives, therefore, the full F&A will be assessed. Any remaining residual funds after the full F&A rate is assessed will then be transferred to a fixed price complete designated account for department use.

Continuation Proposals

A continuation proposal, for a project previously granted an F&A reduction or waiver, will require a new request for F&A cost reduction for the continuation, unless it is clear that Research, Innovation & Impact granted the initial F&A cost reduction for the life of a project.

If submitting a new or continuation proposal for a project under a Master Agreement with a pre-negotiated F&A rate, please indicate this to Sponsored Projects Services with a note on the Abstracts & Attachment page of the proposal in UAccess Research.

Grant Transfers to the University of Arizona

When a new faculty member transfers their grants to the University of Arizona from their previous institution RII will accept the previous institution’s F&A rate for the period remaining on the grant*. Continuation, supplemental, and competing funds on transferred grants must be proposed using the University of Arizona’s negotiated rates.

*NSF is the exception. Accepting the F&A Rate from the Original Institution (OI) is viewed as voluntary committed cost-share by NSF and is strictly prohibited. NSF transfer awards must be done at current University of Arizona F&A Rates.

Corporate and Industry Sponsored Clinical Trials

Clinical trials are generally conducted off campus, normally with a substantial patient care component in the budget using a standard agreement. Considering that clinical trials involve insignificant facilities and maintenance costs, and minimal administrative costs, and a patient care component, the University will accept a 30% Total Direct Cost (TDC) F&A cost rate for clinical trials that meet the eligibility requirements and use the standard University agreement. The University must ensure that federal sponsors do not in any way subsidize the F&A costs of other sponsors. The clinical trial F&A cost rate of 30% Total Direct Costs is a fair rate and adequately reimburses the University for the F&A costs associated with conducting clinical trials. Studies not meeting all the eligibility criteria or those studies not using the standard agreement or similar terms will be budgeted at the full on campus research F&A cost rate, including federally funded clinical trials.

Eligibility requirements for the 30% TDC Clinical Trial F&A Cost Rate:

- The study is consistent with the University’s mission.

- Human subjects are utilized in the study.

- Spending of award by budget category is discretionary.

- Limited accountability of funds, no requirement for return of unused funds.

- Sponsor provides drug or device to be tested, has tested it on animals, has obtained FDA approval to proceed to clinical trial, and has been issued an investigational drug or device number.

- The clinical trial agreement is compatible with the University-approved standard agreement.

Information on budgeting F&A costs can be found on the Budget Categories page.